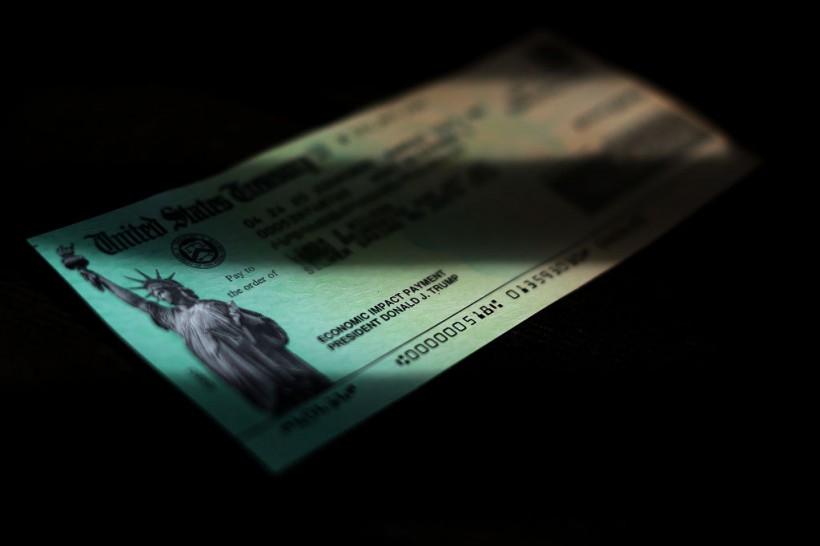

Stimulus Check Extension: Are You Eligible for Up to $5000 in Payments?

Millions of Americans may still qualify for stimulus checks, but time may be running out when it comes to claiming those checks, according to the U.S. Government Accountability Office.

CNBC News reported that individuals with no income and not required to pay taxes can still complete a simiplified tax return to receive compensation.

The qualified applicants can still submit the information by November 15 while taxpayers who did not meet the deadline in April have an extension until October 17.

Those who qualify for the stimulus check extension can fill out and submit a tax return on the Internal Revenue Service's free tool.

An estimated 9 to 10 million people are eligible for the payments, but they have yet to file their taxes.

GAO noted that individuals who think they may qualify but did not receive a COVID-19 payment in 2020 or 2021 can file a simplified return at the ChildTaxCredit.gov website.

Certain groups may have faced difficulty receiving their payments, such as those who had never filed a tax return or filing a tax return for the first time; in mixed immigrant status families; did not have a bank account or access to a bank; had limited or no access to the internet; and experiencing homelessness.

READ NEXT: Social Security Payments: Here's Why Increase in Benefits Could Not Be as Big as Expected

Child Tax Credit

The federal government distributed $931 billion in COVID-19 stimulus payments from April 2020 to December 2021.

Forbes noted that the child tax credit was also expanded during the pandemic, with payments of up to $300 per child to qualifying families.

GAO said that the challenge for IRS and the Treasury Department in 2020 was that they only had data on taxpayers that had previously filed taxes.

The agencies involved reached out to about nine million people who had not filed taxes to let them know that they are eligible for the Child Tax Credit.

IRS Commissioner Chuck Rettig noted in a news release that the IRS is reminding eligible people, especially families to file their tax return for 2021 to review options for important tax credits, according to an Axios report.

There is also an increased Child and Dependent Care Credit for a tax credit for families who pay for daycare of up to $4,000 for a qualifying child and $8,000 for two or more.

Stimulus Check Update

The maximum credit for each qualifying adult for stimulus payments is $1,400 while each eligible child or adult dependent has a maximum credit of $1,400, as well.

Individuals with incomes below $12,500 and couples below $25,000 may be able to file a "simple tax return" in as little as 15 minutes, according to IRS's website.

Meanwhile, people can also claim a missing stimulus payment. Individuals can visit the IRS website for Economic Impact Payments and follow the instructions from there, as reported by CBS News.

On the other hand, states are sending relief payments to cushion the impact of inflation, such as California, Delaware, Hawaii, and Indiana among others.

Californians are set to receive a check of up to $1,050 either by direct deposit or through the mail.

READ MORE: SSI Payments Schedule: Here's Why You Won't Be Getting $841 to $1261 This October 2022

This article is owned by Latin Post.

Written by: Mary Webber

WATCH: Stimulus checks: 10 million people are still eligible for payments — but have 1 month to claim them - from News 19 WLTX

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!