It’s Time to Invest in Gold

It's Time to Invest in Gold

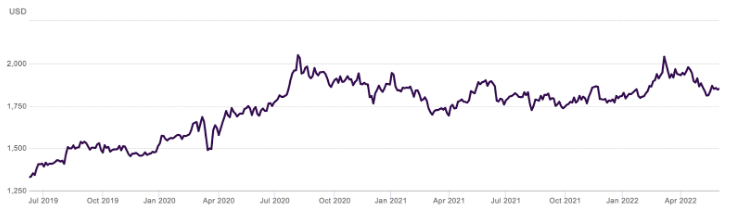

We have entered an era of 1970s style stagflation, combining stagnant economic growth with high inflation. In a time of stagflation, real assets such as gold tend to outperform other asset classes. The storm of stagflation has been gathering for the last few years and the gold price has responded by taking off in the last three years. In the last three years, the gold price has risen by nearly 40%, according to the World Gold Council. A report in the Economic Times suggests that now is the time to buy gold.

Stagflation Will Increase Demand for Gold

Stagflation last hit the world in the 1970s. In that time, gold was the best performing asset class and overall, commodities were really by far the best asset class. Gold is the safe haven of choice for a stagflationary environment and as you can see from how gold has performed in the last three years, investors have increasingly sought to get more exposure to gold.

Although gold has shown some weakness, investors should not lose sight of its long-term value.

The Fed May Be Too Late

Many investors and market experts such as JP Morgan Chase's chairman and CEO, Jamie Dimon, have opined that the Federal Reserve has been slow to raise interest rates. Bill Ackman believes that at this point, the only way to stop the stagflation train is if the Fed aggressively tightens monetary policy. The Fed so far has not signaled a willingness to aggressively cut rates.

The World Bank's outlook and data from the economy may lead to more aggressive rate hikes.

The Fed's slowness in raising rates means that investors should bake in stagflation over the next few years. The consequence of stagflation will be a rise in gold prices.

Gold Has a Lot of Strength Left

Stock market watchers will note how the S&P 500 has continued to decline over the year, and how the stock market as a whole has struggled to deliver the gains it did in years past. Across the world, indices are down significantly year-to-date.

Stocks remain highly volatile, whereas gold's volatility remains low in comparison. At a time of uncertainty, gold will become more attractive because investors will be looking for more security and investing in highly volatile asset classes is just not the thing that investors will be looking to do. In fact, research shows that investors tend to flock to gold after suffering steep losses in the S&P 500. In the ten worst quarters in the S&P 500, gold has delivered positive returns in nine of the ten successive quarters. That suggests that gold is likely to improve as stock markets stumble.

How Investors Can Invest in Gold

Investors should invest in gold. The most typical ways of doing so is by investing directly in gold through bullion, coin and jewelry; investing in gold exchange-traded funds (ETFs) which invest in directly in gold, or in gold miners; and by investing in top gold IRA companies which invest in physical gold and take care of the storage and insurance aspects of directly owning gold.

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!