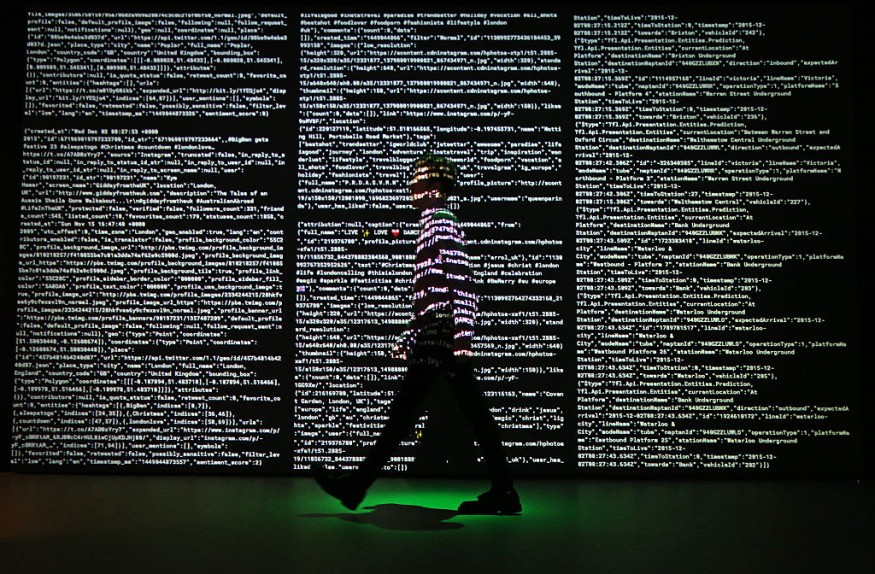

Oregon DMV Data Breach Affects 3.5 Million Residents: Are You One of Them?

The Oregon Department of Transportation (ODOT) has recently informed the public about a significant data breach that resulted in the compromise of personal information belonging to 3.5 million Oregon residents, according to KOIN.

The Oregon data breach has raised concerns about the privacy and security of individuals' private DMV records.

ODOT promptly secured its systems after discovering the Oregon DMV data breach. However, due to the nature of the incident, it is estimated that approximately 90% of Oregonians with state driver's licenses and ID cards may have been affected.

ODOT cannot determine with certainty whether the hackers accessed an individual's specific information.

To address the situation, there are steps individuals can take to assess the potential impact on their data. While ODOT cannot provide direct information on specific breaches, alternative methods are available to help individuals determine if their data has been compromised.

What To Do Against the Oregon DMV Data Breach?

When you receive your credit reports, it is essential to review them carefully and look for any transactions or accounts that you do not recognize, per DataConomy.

Suppose you come across anything you need help understanding. In that case, it is recommended to call the number provided on the credit report or visit the Federal Trade Commission's website on identity theft for further information. Taking these steps can help you address any potential issues.

Consider requesting a credit freeze from the three credit monitoring companies: Experian, Equifax, and TransUnion.

They have customer support hotlines that you can reach at 1-888-397-3742, 1-800-685-1111, and by visiting experian.com/help.

Oregon residents should be aware that they have the legal right to receive a free copy of their credit report from Equifax, TransUnion, and Experian once a year upon request.

This is a crucial resource to understand who has access to your credit history. To obtain your Annual Credit Report or call 1-877-322-8228.

Protect Your Digital Information

Ensuring the security of your online accounts is crucial in protecting yourself against identity theft. One fundamental step is to use secure and unique passwords for each of your accounts, OregonLive noted.

A strong password is difficult to guess, so consider using a combination of capital and lowercase letters, numbers, and special characters. Having unique passwords prevents a potential breach in one account from compromising your other accounts.

To help manage your passwords effectively, consider using password manager apps. These tools securely store your passwords and can generate complex passwords for you.

Additionally, enabling two-factor authentication adds an extra layer of security by requiring a secondary verification method, such as a unique code sent to your phone, when logging into your accounts.

Smartphones can be vulnerable to identity theft, so taking precautions is essential. Set a passcode on your phone to restrict unauthorized access, and consider adding a security code to your phone account for added protection.

Keeping your phone's software up to date is crucial, as updates often include security patches. It's essential not to delay updating your phone, as scammers may exploit any vulnerabilities during that time.

READ MORE : CHP Found Fentanyl in San Francisco

This article is owned by Latin Post.

Written by: Bert Hoover

WATCH: 3.5 million Oregonians potentially impacted by DMV data breach - From KGW News

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!

© 2026 Latin Post. All rights reserved. Do not reproduce without permission.