2 Million Californians Urged to Claim Stimulus Checks On or Before October 15

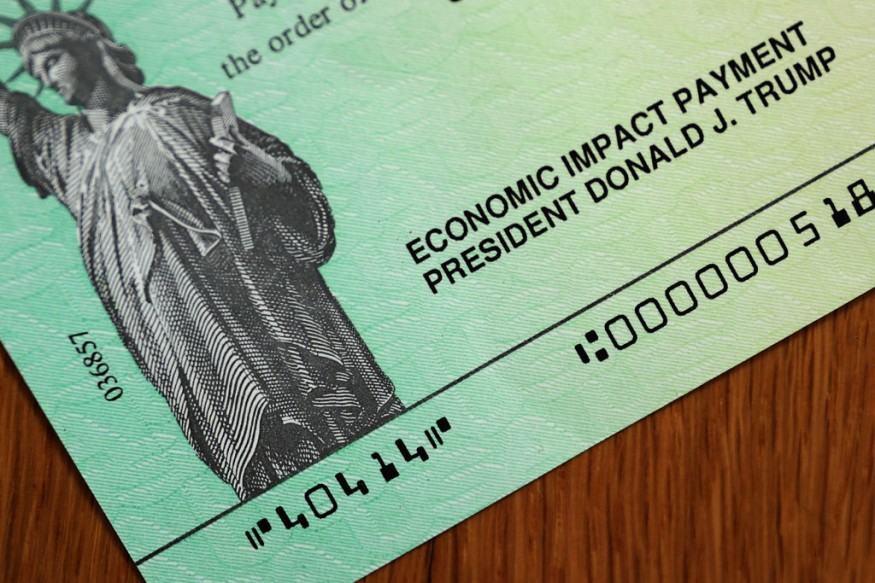

About two million Californians are urged to claim their first stimulus checks otherwise known as the Economic Impact Payments (EIP) on or before October 15.

This is because they are part of the about nine (9) million in the U.S. whom the Internal Revenue Service (IRS) have mailed letters notifying that they may have been eligible to receive the first stimulus checks which were part of the CARES Act that was approved in March.

The reason why they may not have claimed it yet is because they were unaware that they were qualified to receive the one-time stimulus payments of $1,200 per adult and $500 per dependent under the age of 16 years old.

So, who are these people? They are the low-income taxpayers who did not file a 2018 or 2019 tax return. This means they earned money but not enough to file tax returns.

They may have been missed by the IRS because the Congress had relied on the IRS to get the funds out as quickly as possible while everything has been shut down since early March due to the COVID-19 pandemic.

What the IRS did then was to identify families who pay taxes and used their tax returns to check if they were qualified to receive the stimulus checks.

Considered as low-income taxpayers are individuals earning below $12,200 or married couples who have a combined income of below $24,400.

The IRS were able to identify those who did not receive the stimulus checks by going through the W-2s and 1099s.

However, to prevent people from getting scammed, the IRS has posted a copy of the official notification letter and are urging them not to respond to anything that does not directly come from the IRS.

As an example, the IRS warns not to give any private information to anyone emailing and asking for it, claiming they are from the IRS.

The IRS also said that there is no need for a third party to claim someone's stimulus check so people should be wary of someone offering to do so for a fee.

It is also possible that someone may receive a notification letter from the IRS but is not really eligible to receive the stimulus checks.

Those qualified are U.S. citizens and resident aliens, have work-eligible Social Security number and not eligible to be claimed as a dependent on someone else's tax return.

Those who are not required to file a 2019 tax return can claim their stimulus checks by visiting the IRS.gov/eip by October 15, 2020. They can click on the "Non-Filers: Enter Payment Info Here" and fill in the bank account details. The IRS will deposit the funds directly to the bank account. Or, if there is no bank details, the IRS can mail the paper check.

As for those who are required to file a 2019 tax return but has not done so, they must do so immediately. The fastest way to dot it is to electronically claim the stimulus checks.

For those who did file but still did not get their stimulus checks, they can check the status of their EIP via the IRS.gov/eip and clicking on "Get My payment."

According to the IRS, the stimulus checks must be claimed by October 15 or else wait until the next filing of their tax return to claim their EIP.

If they cannot file a 2019 tax in 2020, they can claim a recovery rebate credit in 2021 when they file their 2020 taxes.

Check these out:

IRS Schedules Second Stimulus Check by October 12 As Soon As Congress Approves

IRS Urges Everyone to Claim $1,200 Stimulus Checks

Second Stimulus Checks: Families Can Get as Much as $4,400 as Early as October 12

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!

© 2026 Latin Post. All rights reserved. Do not reproduce without permission.