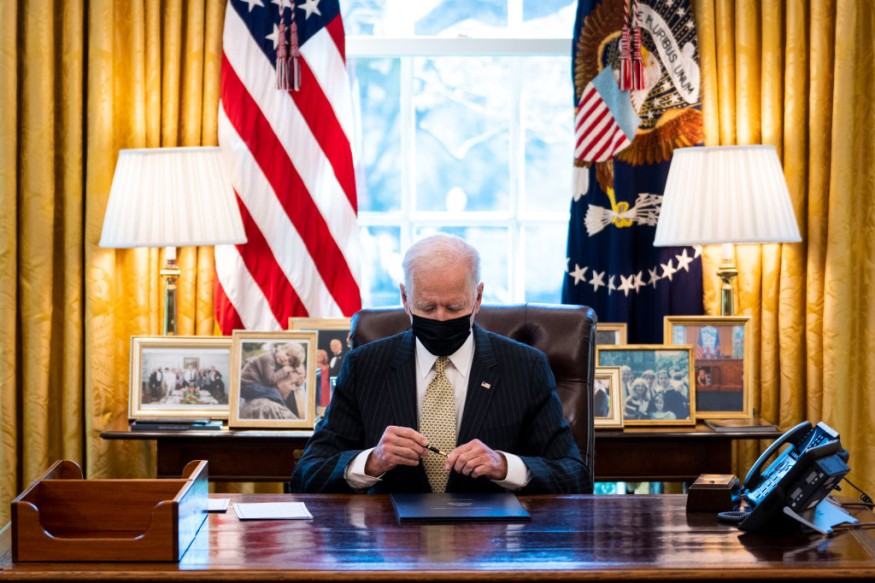

PPP Small Business Aid Extensions Signed Into Law by Biden, Will Extend Until May 31

U.S. President Joe Biden inked the PPP or the Paycheck Protection Protection extension into law, the day before it is set to expire, pushing it until May 31. The law aims to extend the help towards small businesses.

In both the House and the Senate, the said bill passed with immense bipartisan support. The Senate sent the PPP Extension Act five days prior to its signing, as the bill was immediately approved by the Senate. It extends the small-business lending program within a two-month period, permitting the Small Business Administration to continue processing loan applications through the end of June, CNN reported.

Bipartisan accomplishment

According to Business Insider, before signing the bill, the U.S. President shared that before signing the bill, Biden declared the law as a bipartisan accomplishment. Biden also said that if he will not be signing the bill within the day, there will be hundreds of thousands of individuals who would lose their jobs, aside from the possibility of closures of small family businesses permanently.

In addition, even lawmakers praised the passage of the PPP extension, as they acknowledge the fact that a lot of small businesses are still struggling financially after taking hits from damages brought by the ongoing COVID-19 pandemic. The U.S. president also included in his stimulus plan a $50 billion budget for small businesses, and specifically $7.25 billion allocated for the PPP when he signed the American Rescue Plan.

Based on the latest data from the Small Business Administration, as of the latest record, the PPP has given out 8.2 million small-business loans, which sums up to $718 billion, aiding a huge portion of small businesses in continuing their payment in their bills throughout the global health crisis. But despite its good intentions, since its establishment under the CARES Act in March 2020, the PPP's loan disbursement has come in for criticism, Fox Business reported.

One of which is the issue connected with the fast-food chain Shake Shack, wherein the company was able to get $10 million of loan. Critics complained about the issuance of the loan as the program is only intended for businesses with 500 or fewer employees. After the investigation done with some large companies who were able to get the loan funds, later on, the company returned the loan funds.

Aside from the not qualified companies who got into the loan program, the Office of the Inspector General also found that the PPP had distributed duplicate loans to more than 4,000 borrowers because of problems in the Small Business Administration's control, which would have to be paid back. However, despite some inconsistencies with the loan program, lawmakers still support its intentions.

Moreover, both Republican and Democratic lawmakers have stated that the benefits of the PPP outweigh its detriments and are needed in order to provide relief to small businesses around the U.S. during the pandemic. Sen. Ben Cardin of Maryland said on the Senate floor last week that the loans by the government saved small businesses all over the nation and they would not be still there without this program.

RELATED ARTICLE : Federal Eviction Moratorium Extended Until June, CDC Says

WATCH: Biden Signs PPP Extension Act | NBC News - NBC News

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!

© 2026 Latin Post. All rights reserved. Do not reproduce without permission.