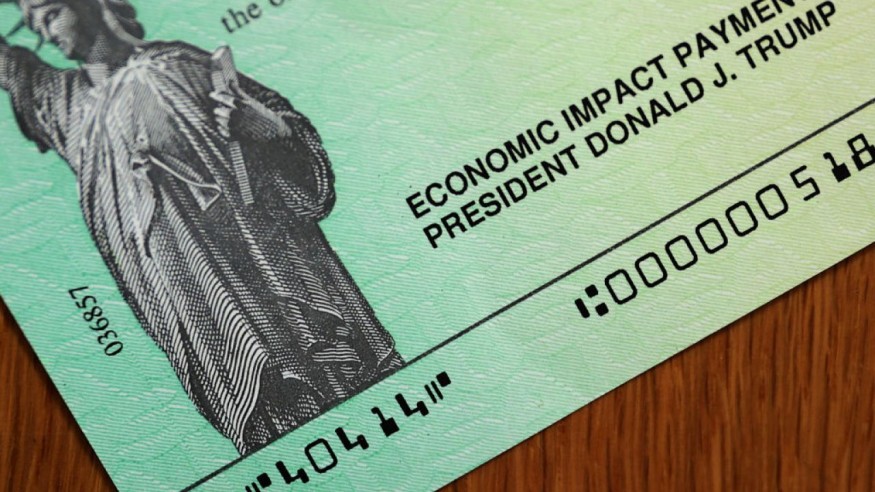

Will You Receive $1,200 Stimulus Check from IRS?

The Internal Revenue Service announced recently that they will be sending a special mail to an estimated 9 million Americans to claim a stimulus check.

The IRS will begin to mail nine million Americans across the country to process their $1,200 stimulus checks and $500 dependent stimulus payment. These are for qualified individuals who did not receive the aid because they did not file their 2018 or 2019 tax returns.

The IRS said that the letter intends to urge these qualified individuals to register at IRS.gov to claim their stimulus checks before the year ends. A qualified individual will receive $1,200 while $2,400 for a couple of those who jointly filed their taxes.

Moreover, parents who have children who are 17 years old below before 2019 ended will also receive $500. The IRS also added that people who will receive the mail have meager incomes but still are eligible to receive the stimulus checks.

IRS Commissioner Chuck Rettig said, "The IRS has made an unprecedented outreach effort to make sure people are aware of their potential eligibility for an Economic Impact Payment this year. "Millions who don't normally file a tax return have already registered and received a payment."

He also added, "We are taking this extra step to help Americans who may not know they could be eligible for this payment or don't know how to register for one. People who aren't required to file a tax return can quickly register on IRS.gov and still get their money this year."

The IRS also made sure that the letter is using English and Spanish language so that it will be easily understood by Hispanics and Latinos who are qualified in the program. The letter or the mail is officially known as IRS Notice 1444-A. That includes information on eligibility criteria and how eligible recipients can claim an Economic Impact Payment.

Moreover, the IRS also clarified that those who will receive the letter or the letter do not necessarily mean they are automatically qualified for the program. An individual is likely to receive the stimulus checks if he or she is:

- U.S. citizen or resident alien

- Has a work-eligible Social Security number

- And can't be claimed as dependent on someone else's federal income tax return.

However, the Internal Revenue Service also reminded that there could be various reasons that a person will not become eligible for the stimulus check. For this reason, they advised those who will receive the mail or letter to visit the IRS website.

The deadline for the registration will be on Oct. 15, and those who failed to file their application will have to wait until next year and claim it as a credit on their 2020 tax return by filling in 2021. The IRS emphasizes that anyone required to file either a 2018 or 2019 tax return should file the tax return and not use the Non-Filers tool.

Rettig concluded, "People who normally don't file a tax return shouldn't wait to see if they receive one of these letters. They can review the guidelines and register now if they're eligible."

Check these out!

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!

© 2026 Latin Post. All rights reserved. Do not reproduce without permission.