Intel Delay on Next-Gen Chips Paves the Way for TSMC Success

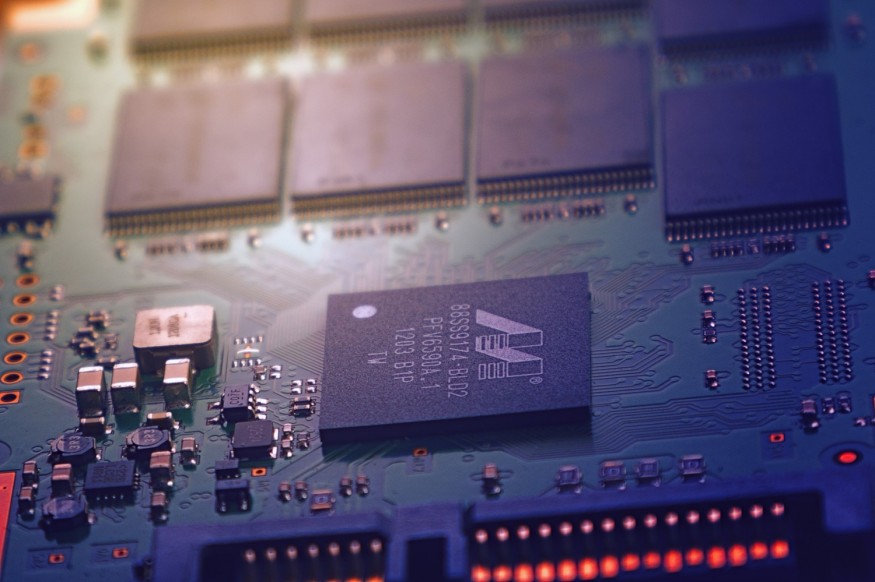

Taiwan Semiconductor Manufacturing Company (TSMC) is now the 10th most valuable company after a recent surge in stock by almost 10% saw it reach a peak value of $413 billion. This change in fortune comes asa result ofIntel, one of TSMC's main competitors, announcing that its next-generation chips are delayed until at least 2022.

The setback for the American company could make way for the Taiwanese chipmaker, which bumped huge organisations such as Johnson & Johnson off the top 10 and sat ahead of global brands such as Walmart and Nestle.

In his Daily Commodity Outlook, Desmond Leong from Tickmill said: "Asian stocks surged thanks to a continuing rally in Taiwan Semiconductor Manufacturing Co."

With TSMC's value soaring, Taiwan's Taiex benchmark index was up to a 30-year high.While this high was short-lived asTSMCclosed trading at 2.47% up, this represented a 39% gain in the month of July to date.It was enough to ruffle feathers throughout the markets and reflected the steps being taken in light of Intel's announcement.

Intel had planned on launching its 7nm-based CPU product at the end of 2021.However, inits recent Q2 announcement, the American company explained thatthe rollout of the 7nm isdelayed by six months. Bob Swan, Intel CEO, said : "We now expect to see initial production shipments of our first Intel-based 7nm product, a client CPU in late 2022 or early 2023."

To add to this, a 'defect mode' has been identified in the 7nm process that has led to yield degradation issues, putting the process back by 12 months. This news saw Intel's shares drop 18% the next day.

This is one of several changes in fortune for Intel that has allowed TSMC to benefit. In June, Apple announced it was switching from Intel to TSMC for its supply of semiconductors for its Mac computers. To add to this, July saw Nvidia beat Intel to become the most valuable America-based semiconductor company. Nvidia is another TSMC client, having placed orders for 7nm and 5nm chips with the Taiwanese company in May.

The successes on the stock market that TSMC has seen is down to how well it is positioned, according to Quincy Liu, chairman of Shin Kong Investment Trust Co. He said: "TSMC's ability to make high-end chips for artificial intelligence, high-performance computing and smart manufacturing applications in the 5G era give it an invaluable role, allowing it to benefit from both the 'de-Americanization' and 'de-Sinicization' trends."

With Intel on the backfoot, it looks like TSMC could make further gains while the wait for the American company to release its 7nm chip.

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!

© 2026 Latin Post. All rights reserved. Do not reproduce without permission.